Kohl’s, one of the largest department store chains in the United States, offers a loyalty program called MyKohlsCard, designed to help shoppers save more money through special rewards, discounts, and exclusive benefits. This program is tied to the Kohl’s Charge card, which is a store-specific credit card that gives cardholders a variety of ways to earn points and discounts.

The main way MyKohlsCard works is by earning Kohl’s Cash and Kohl’s Rewards Points when you make purchases with your Kohl’s Charge card. For every dollar spent at Kohl’s, you can accumulate rewards points that can later be redeemed for discounts on future purchases.

Key Features of MyKohlsCard.com Portal

The MyKohlsCard portal offers several key features designed to help Kohl’s Charge cardholders easily manage their accounts, track rewards, and take advantage of exclusive deals. Here’s a breakdown of the most important features.

Here are the key features of the MyKohl’sCard portal in simple, one-liners:

- Account Management: View balance, make payments, and track spending.

- Reward Tracking: Check and redeem Kohl’s Rewards points.

- Kohl’s Cash Management: View and redeem Kohl’s Cash on purchases.

- Exclusive Deals & Coupons: Access personalized discounts and special offers.

- Early Sale Access: Get early access to sales and promotions.

- Account Settings: Update personal details and set up alerts.

- Order Tracking: Track your online purchases and delivery status.

- Customer Support: Easy access to help and dispute resolution.

Why Choose MyKohl’sCard?

MyKohl’sCard offers numerous benefits that make it a great choice for regular Kohl’s shoppers. By using your Kohl’s Charge card, you earn Kohl’s Rewards points on every purchase, which can be redeemed for discounts on future buys. Additionally, you can earn Kohl’s Cash during promotional events, which acts like store credit for even more savings.

The card also gives you access to exclusive discounts, personalized offers, and early access to sales, allowing you to get the best deals before they’re available to everyone. Managing your account is easy through the MyKohl’sCard portal or Kohl’s app, where you can track rewards, make payments, and access digital coupons—all in one place.

With the added convenience of paperless statements and exclusive member benefits, MyKohl’sCard helps you save more while enjoying a seamless shopping experience.

Access Your Kohls Credit Card Account Online

To get to your Kohl’s card data, visit mykohlscard.com to get everything rolling.

Eligibility for Mykohlscard.com Login

To be eligible for MyKohlsCard.com Login, you must meet the following basic requirements:

- Age: Be at least 18 years old.

- Credit Score: Have a fair credit score of 640 or higher.

- Income: Your monthly income should exceed your monthly rent or mortgage payment by at least $425.

- Identification: Possess a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Residency: Have a physical U.S. address (P.O. boxes and correctional institutions are not acceptable).

- Bank Account: Maintain a checking or savings account.

- Credit History: Ensure you do not have:

- More than six open Capital One credit card accounts.

- A past due Capital One credit card account.

- A charged-off Capital One credit card within the past year.

- An existing Kohl’s Credit Card or an application in progress.

- A credit freeze or lock that prevents Capital One from accessing your credit report.

- A valid Username and Password.

- An updated browser to access the official site.

- Reliable internet connection.

- A laptop, tablet, or smartphone via a PC, laptop, or smartphone.

Once you meet these criteria and are approved for the Kohl’s Charge card, you can automatically enjoy all the benefits of the MyKohl’sCard program, including rewards, discounts, and access to exclusive offers.

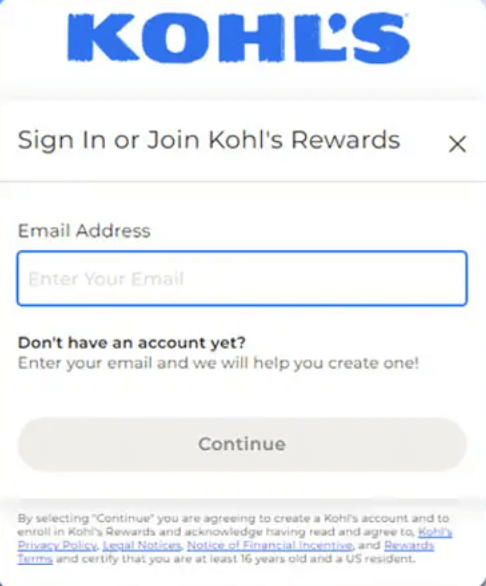

✅ MyKohlsCard Login Process

- Open a valid browser.

- Go to the official website – www.mykohlscard com.

- Now, you are requested to your User Name and Password.

- After that, click the Submit button.

- And finally, the login process has been successfully completed to manage your account.

✅ Apply for a Kohl’s Credit Card

To use MyKohlsCard, you must first apply for and receive approval for a Kohl’s Credit Card (issued by Capital One).

- To apply for a new card, open My Kohl’s Charge Login website at – credit.kohls.com.

- Now, click on the option Apply Now.

- You will be redirected to a new page.

- Please enter all the required details such as –

- Your First and Last Name

- Email ID

- Phone Number

- Your Home Address – street address and Zip Code.

- Date of Birth

- Social Security

- Annual Income

- Now, click the review option to check that your provided details are right.

- Once you have completed it, click on continue to complete the process.

- Follow the instructions, avail yourself of your card and account, and complete MyKohlscard com login.

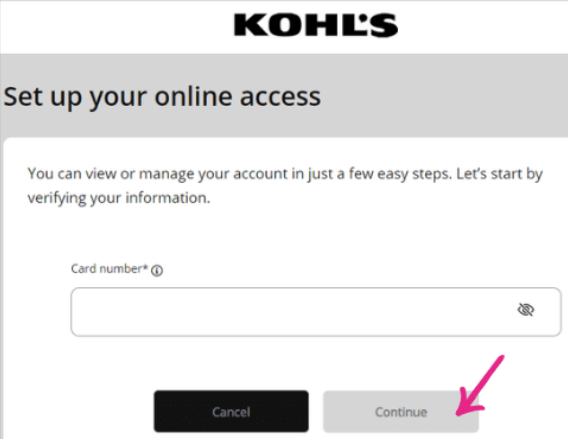

🟦Register Your Account at MyKohlsCard.com

Once you receive your Kohl’s Credit Card, you can register your account online to manage payments, view statements, and more.

✅ Steps to Register:

- Visit: https://www.mykohlscard.com

- Click: “Register Now”

- Enter:

- Your 16-digit Kohl’s card number

- Your name as it appears on the card

- Security code (on the back of the card)

- Last 4 digits of SSN

- Create:

- Username

- Password

- Set up security questions

- Submit and log in.

How to Became MVC (Most Valued Customer)

To become an MVC:

- ✅ Spend $600 or more in a year using your Kohl’s Credit Card.

Once you qualify, you’ll automatically be upgraded to MVC status.

MVC Perks Include

| Benefit | Description |

|---|---|

| 🎉 Exclusive Discounts | Extra savings events just for MVC members throughout the year. |

| 📩 More Coupons | Frequent and higher-value discount mailers and emails. |

| 🛍️ Kohl’s Cash® Opportunities | Additional chances to earn and redeem Kohl’s Cash during promotions. |

| 🔔 Early Sale Alerts | Advanced notice of upcoming promotions and events. |

| 💌 Birthday Gift | Often includes special offers or coupons during your birthday month. |

💡 Notes:

- MVC status is reviewed annually, so you need to spend $600 or more each year to retain the status.

- All spending must be done using your Kohl’s Credit Card.

- MVC status is account-specific, not per customer — so joint account holders each need to qualify individually if they have separate accounts.

If you’re close to the $600 threshold and wondering how far you are from MVC, you can check your account activity on MyKohlsCard.com or ask Kohl’s customer service for details.

💳 How to Pay Your Kohl’s Credit Card Bill

You can pay mykohlscard bill in several convenient ways:

1. Online Payment via MyKohlsCard.com

The fastest and most convenient method:

- Go to https://www.mykohlscard.com

- Log in to your account.

- Select “Make a Payment.”

- Enter:

- Payment amount

- Payment date

- Bank account details (routing and account numbers)

- Submit and confirm.

✅ Payments before 7 p.m. CST will be posted the same day.

2. Mobile Browser (No App Needed)

MyKohlsCard.com is mobile-optimized. Just log in using your phone browser and follow the same steps as online payment.

3. In-Store Payment

You can pay at any Kohl’s store at the register.

- Visit your nearest Kohl’s location.

- Bring your credit card or account number.

- Pay via:

- Cash

- Debit card

- Check

- Kohl’s gift card (in some cases)

🕒 Store payments post same day if made during business hours.

4. Phone Payment

You can make a payment via Kohl’s automated phone system or speak to a representative.

Call: 1-855-564-5748 📞

- Select the “Make a Payment” option.

- Follow the prompts to enter your card and bank details.

⏱️ Available 24/7

May incur a fee if made with the help of a live agent (free via automation).

5. Mail-In Payment

You can also send a check or money order via mail.

Mail To:

Kohl’s Payment Center

P.O. Box 60043

City of Industry, CA 91716

Your Kohl’s Credit Card account number on the check

Allow 7–10 days for delivery and processing

what is Yes2You Rewards in mykohlscard

Yes2You Rewards was Kohl’s previous loyalty program, which has been replaced by the Kohl’s Rewards program. If you were a Yes2You Rewards member, your account was automatically transitioned to Kohl’s Rewards, and any existing points were converted accordingly.

Is MyKohl’sCard Worth It?

| Feature | Value to You |

|---|---|

| Discounts | Frequent, stackable savings |

| Rewards | 7.5% back in Kohl’s Rewards |

| No Annual Fee | Zero ongoing cost |

| Online Access | Easy account management |

| MVC Perks | Extra coupons and birthday gifts |

| Stackable Savings | Combine with Kohl’s Cash & coupons |

Kohl’s Credit Card Customer Service Phone Numbers

Primary Contact: 1-844-463-7013

- Available 24 hours a day, 7 days a week

Alternate Number: 1-800-564-5740

- For assistance with different card types or if you’re unsure about your card type

Capital One Servicing: 1-888-647-1712

- For inquiries related to the Capital One servicing platform for Kohl’s Credit Cards

the mailing address to dispute a charge is:

Capital One Disputes,

P.O. Box 30279,

Salt Lake City,

Utah 84130-027